What is a Social Security Tax Withholding Form

Commonly known as W-4, an IRS-w-4v is a tax form used by the payer to withhold federal income tax. The form is designed to automate the withholding on various types of non-wage income such as unemployment benefits, social security benefits, or crop disaster payments. Consider completing a new w-4v form each year and when your financial position changes.

Information Required on a Social Security Tax Withholding Form

Before you fill out the form, it is essential to understand what information is needed to complete the form. This knowledge is necessary to help you fill the form quickly, accurately, and efficiently. Some of the filing data to write in the form include:

- Personal information(your identity as either single, married, or bread-winner)

- Filing status

- Any job adjustments

- Amount of credits

- Amount of other incomes

- Amount of deductions

- Other amounts to withhold

How to Complete a Social Security Tax Withholding Form

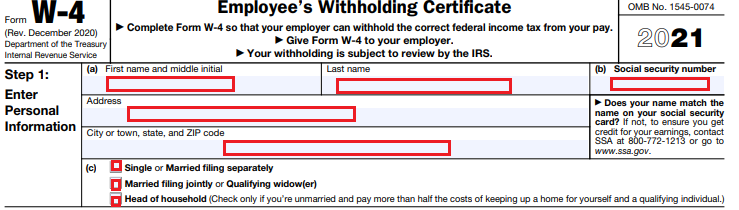

Section 1 - Personal Information

Enter your personal details, including your names and social security number(SSN). Also, add your address and current city or town. Use the checkboxes to indicate if you are filing the form as either single, married, or a qualifying widow(er) and head of household.

Section 2 - Job Details

This part only applies to individuals with multiple jobs and a working spouse and people whose income conditions indicate they should withhold more or less than the usual amount. The section has three options to choose what works for you.

Option A - Utilize the IRS’s online tax withholding estimator and enter the estimate in step 4 when applicable.

Option B - This option only applies to the couple with the higher-paying job for the most accurate withholding. They must fill out the multiple job worksheets provided on page 3 of the form.

Option C - Only check the box in this part if there are only two jobs total for the two of you. It only makes sense if both of you earn about the same, or else more tax may be withheld than required.

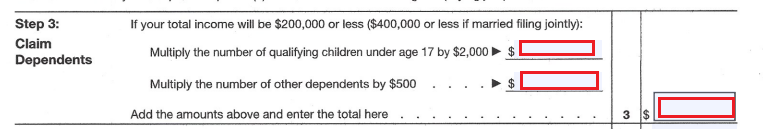

Section 3 - Dependents

In this section, an applicant indicates the number of dependents and children qualifying under 17 years. One must calculate both the amounts of the dependents and children and enter the total amount in the boxes provided. Children's number is multiplied by $2000 while dependents are multiplied by $500.

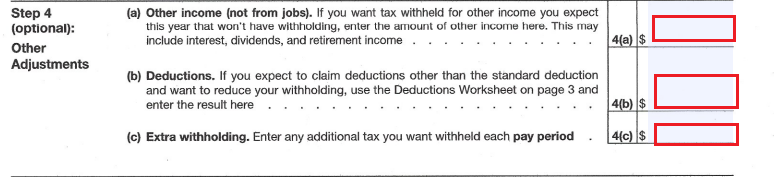

Section 4 - Additional Adjustments

This is an optional section from which you can indicate other reasons to withhold more or less from your paycheck. That may include other income(not from jobs) like passive investments, deductions, and any additional extra withholding tax.

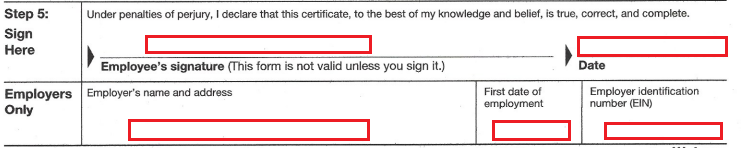

Section 5 - Signing Details

On the blanks provided, sign and include the date to make the form valid. It also holds employer details blanks to fill in their name, address, the first date of employment, and the employer identification number(EIN).

Common Uses of a Social Security Tax Withholding Form

Generally, the W-4 form is used to indicate how much an employer can withhold for your annual tax. It is used to adjust withholding based on exceptional or developing circumstances, like a job or children. Employees can use this form to claim tax credits or deductions. This form is essential to avoid a surprising annual tax bill.

Who Needs to Fill Out a Social Security Tax Withholding Form

Any employed person can fill out the W-4 form. The form is for people with simple tax situations like one job, no spouse, no children, to individuals with complex tax issues like having children, dependents, multiple positions. It is important to note that the IRS requires people to pay taxes on their income throughout the year gradually.